In Texas City, car title loans have become popular due to their speed and accessibility, offering a secured alternative to bank loans with less stringent eligibility requirements. Lenders assess your vehicle's value for loan amounts, and terms range from 30 days to a year, allowing repayment in manageable installments while keeping your vehicle as collateral. These loans provide a secure way to access cash, but borrowers must maintain their vehicles and make timely repayments to avoid losing ownership. Texas City car title loans offer quick approval and can boost credit history with responsible repayment.

“Texas City residents often turn to car title loans as a quick financial solution. This article delves into the safety and reliability of such loans within the city’s framework. We explore ‘Understanding Car Title Loans in Texas City’ and dissect the safety measures in place, offering insights into the benefits and risks involved. By weighing these factors, borrowers can make informed decisions regarding car title loans, ensuring a secure financial path.”

- Understanding Car Title Loans in Texas City

- The Safety Measures in Place for Texas City Car Title Loans

- Benefits and Risks: Weighing the Options for Car Title Loans in Texas City

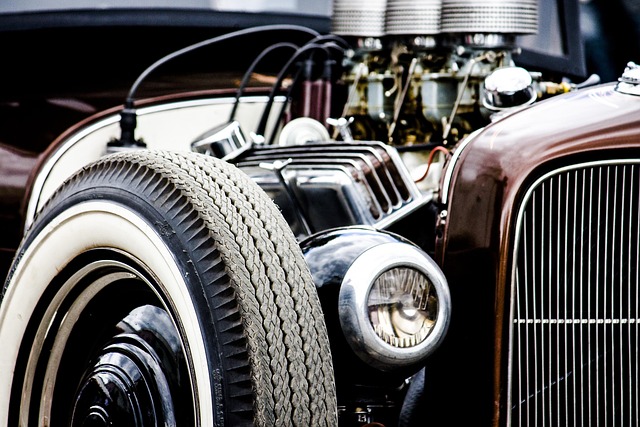

Understanding Car Title Loans in Texas City

In Texas City, car title loans have emerged as a popular option for individuals seeking quick access to cash. This type of secured loan utilizes your vehicle’s title as collateral, offering a straightforward and potentially faster alternative to traditional bank loans. The process involves borrowing money from a lender by handing over your vehicle’s registration, which serves as security until the loan is repaid. Texas City car title loans cater to those with less-than-perfect credit or who need funds urgently, as they often have simpler eligibility criteria compared to other loan types.

Understanding the loan requirements and terms is essential when considering a car title loan in Texas City. Lenders will assess your vehicle’s value and its condition to determine the maximum loan amount. Unlike some loans that may require strict credit checks, these loans primarily focus on the equity and condition of your vehicle. Keep your vehicle maintained and insured throughout the loan period to ensure you can fulfill the agreement terms. Loan terms vary, but typically range from 30 days to a year, allowing borrowers to repay in manageable installments while keeping their vehicles during this time, as long as they meet the agreed-upon payments.

The Safety Measures in Place for Texas City Car Title Loans

Texas City car title loans offer a unique financing option for individuals seeking quick access to cash using their vehicle as collateral. Several safety measures are in place to protect both lenders and borrowers. Firstly, lenders thoroughly evaluate loan requirements, including verifying the borrower’s vehicle ownership and assessing the vehicle equity. This process ensures that the lender is securing a legitimate asset while offering a streamlined loan process. Additionally, these loans often come with clear terms and conditions, providing borrowers with a comprehensive understanding of their obligations, interest rates, and repayment schedules.

Moreover, Texas City car title loans are secured by the borrower’s vehicle, which acts as collateral. This significantly reduces the risk for lenders, as they have legal recourse in case of default. Borrowers should remain mindful of their ability to repay the loan within the agreed timeframe, maintaining their vehicle ownership and avoiding repossession. Regular communication with the lender is key to ensuring a safe and successful transaction.

Benefits and Risks: Weighing the Options for Car Title Loans in Texas City

Car title loans have gained popularity as a quick source of financial assistance for many Texas City residents. These loans are secured by the value of an individual’s vehicle, which can make them an attractive option for those in need of cash fast. However, like any loan product, there are benefits and risks associated with car title loans in Texas City that borrowers should carefully consider before making a decision.

One significant advantage is the ease and speed of the loan approval process. Compared to traditional bank loans or personal loans, obtaining a car title loan often requires less paperwork and can be approved within a shorter timeframe. This makes them ideal for unexpected financial emergencies or urgent needs. Additionally, if managed responsibly, paying off a car title loan can help build credit history and improve borrowing power in the future. However, the primary risk lies in potential loss of ownership. If borrowers fail to repay the loan according to the agreed terms, the lender may initiate a title transfer, resulting in permanent loss of vehicle ownership. Therefore, it’s crucial for prospective borrowers to thoroughly understand the loan conditions and ensure they can comfortably meet the repayment obligations to avoid adverse outcomes.

When considering Texas City car title loans, it’s crucial to balance the benefits against potential risks. While these loans offer quick access to cash and flexible repayment terms, borrowers must be mindful of the associated fees and the possibility of repossession if they fail to meet payments. Understanding the safety measures in place, such as clear title requirements and transparent lending practices, can help ensure a secure loan experience. Always remember that responsible borrowing is key to avoiding financial pitfalls.