Texas City car title loans are a misunderstood but beneficial financial option. They allow vehicle ownership while providing quick cash using the vehicle as collateral, with flexible terms and competitive rates dispelling myths of difficulty, high interest, and penalties. These loans are accessible to many, swift in funding, and ideal for unforeseen expenses.

Unravel the mysteries and dispel common myths surrounding Texas City car title loans. This article aims to provide a clear, concise guide, separating fact from fiction. Delve into the often-misunderstood world of these secured loans, where your vehicle’s title acts as collateral. By addressing and debunking prevalent misconceptions, we empower you with knowledge, enabling informed decisions regarding Texas City car title loans.

- Texas City Car Title Loans: Fact vs. Fiction

- Debunking Common Misconceptions About Loans

- Navigating Texas City Car Title Loan Myths

Texas City Car Title Loans: Fact vs. Fiction

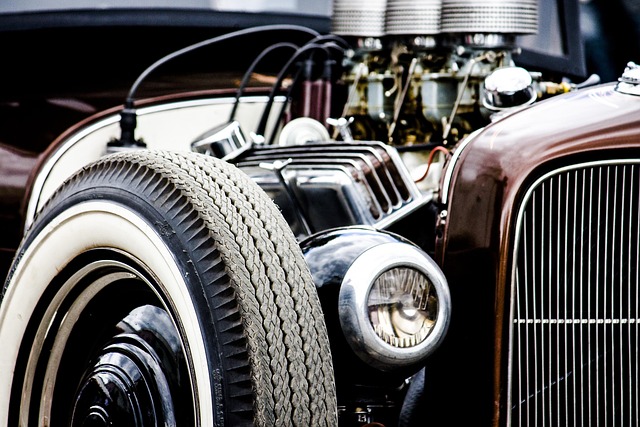

Texas City car title loans have been a topic of many misconceptions, but understanding the facts is essential for anyone considering this financial option. Unlike popular belief, these loans are not a trap designed to leave borrowers in a cycle of debt. In reality, Texas City car title loans offer a straightforward and beneficial solution for those needing quick cash. The process involves using your vehicle’s ownership as collateral, ensuring that you retain possession of your vehicle while accessing much-needed funds.

One common myth is that these loans come with exorbitant interest rates. While it’s true that the interest rate might be higher than a traditional loan, it’s often due to the shorter repayment period and the secured nature of the loan. Moreover, many lenders now offer flexible terms and competitive rates, making Texas City car title loans a viable option for those seeking same-day funding without compromising their vehicle ownership. This alternative can prove particularly useful for emergencies or unexpected expenses, providing a cash advance with minimal hassle.

Debunking Common Misconceptions About Loans

Many people have misconceptions about Texas City car title loans, often formed due to lack of understanding or misinformation from unreliable sources. One common myth is that these loans are too difficult to obtain, but this isn’t entirely true. Lenders offering San Antonio loans and even those in Texas City typically have flexible requirements for loan eligibility, making it accessible to a wide range of borrowers. The process usually involves providing proof of ownership for your vehicle and verifying your income, which can be as simple as showing pay stubs or bank statements.

Another misconception is that car title loans come with exorbitant interest rates and penalties. While it’s true that these loans have higher interest rates compared to traditional personal loans, the flexibility in payments allows borrowers to manage their debt more effectively. Moreover, many reputable lenders offer transparent terms and conditions, ensuring borrowers understand the full cost of their loan before finalizing the agreement. Debunking these myths is crucial for individuals considering Texas City car title loans as a viable financial option.

Navigating Texas City Car Title Loan Myths

Navigating Texas City car title loan myths is essential before diving into this type of financing. Many people have misconceptions about how these loans work and what they entail, often leading to worry and hesitation. One common myth is that Texas City car title loans are exclusively for those with poor credit, but this isn’t true; any vehicle owner can apply, regardless of their credit history. These loans are secured by the value of your vehicle, not your personal credit score.

Another popular misbelief is that these loans come with excessive interest rates and hidden fees. While it’s true that interest rates vary across lenders, Fort Worth loans, for instance, offer competitive rates, especially when compared to traditional bank loans or title pawns. Moreover, transparency is encouraged in this sector, so all charges should be clearly laid out from the start, ensuring borrowers have a full understanding of their repayment obligations. Quick funding is also a myth buster; these loans can often provide funds within a day or two, making them a reliable option for unexpected expenses.

In navigating the complex world of Texas City car title loans, it’s essential to dispel common myths that may deter potential borrowers. By understanding the facts and separating fiction from reality, individuals can make informed decisions about their financial needs. This article has aimed to clarify misconceptions and serve as a guide through the maze of loan options, empowering folks to access the funds they require without unfounded fears.