Texas City car title loans provide swift alternative financing for individuals with less-than-perfect credit or immediate cash needs, secured by vehicle equity and offering quick approval, lower interest rates, and flexible terms compared to unsecured personal loans. However, borrowers should be aware of shorter repayment periods, potential hidden fees, and the need for transparency in all charges.

In Texas, when quick cash is needed, understanding Texas City car title loans can be a game-changer. This secure lending option allows residents to use their vehicle’s title as collateral for a loan. With a simple process and faster turnaround times compared to traditional loans, it offers an attractive solution for those facing financial emergencies.

This article explores how these loans work, their benefits, and considerations, providing Texas residents with valuable insights into accessing immediate funding using their car title.

- Understanding Texas City Car Title Loans: A Quick Cash Solution

- How Do Car Title Loans Work in Texas?

- Benefits and Considerations for Texas Residents

Understanding Texas City Car Title Loans: A Quick Cash Solution

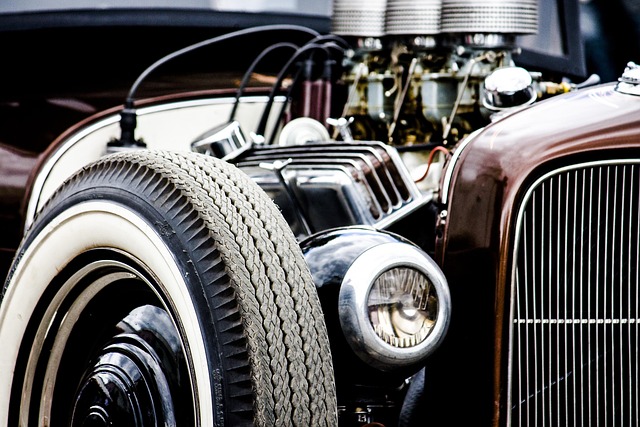

Texas City car title loans offer a unique solution for individuals seeking quick cash. This type of loan is secured by the vehicle’s equity, allowing lenders to provide funds based on the value of your car rather than relying solely on your credit history. It’s an attractive option for those with less-than-perfect credit or no credit at all, as it bypasses the traditional credit check commonly associated with other loan types.

One significant advantage is the speed and ease of the funding process. Unlike bank loans that may involve extensive paperwork and a lengthy wait, Texas City car title loans can offer quick approval and funding, making them ideal for emergency financial needs or unexpected expenses. The lender assesses the vehicle’s equity to determine the loan amount, ensuring it aligns with the market value of your car. This transparent approach provides peace of mind, knowing that you’re receiving fair terms based on your vehicle’s actual worth.

How Do Car Title Loans Work in Texas?

In Texas City, car title loans have emerged as a popular option for individuals seeking quick financial relief. This alternative lending method is designed to provide cash access using your vehicle’s title as collateral. The process begins when borrowers apply for a loan by submitting their vehicle information and necessary documentation. After approval, the lender assesses the vehicle’s equity based on its make, model, year, and overall condition. Once evaluated, the borrower receives a predetermined loan amount, often with faster turnaround times compared to traditional banking options.

The beauty of Texas car title loans lies in their secured nature. Lenders hold onto the vehicle title until the loan is fully repaid, ensuring they have collateral for the borrowed funds. This guarantees borrowers can access lower interest rates and more flexible repayment terms than unsecured personal loans. With a clear understanding of the vehicle’s value, lenders can offer competitive terms, making car title loans an attractive solution for those in need of quick cash while maintaining their vehicle ownership.

Benefits and Considerations for Texas Residents

Texas residents looking for a quick financial boost have an option that’s both accessible and secure: Texas City car title loans. These loans offer several significant benefits. Firstly, they provide a straightforward and swift funding process, with minimal paperwork and fast approval times, making them ideal for urgent financial needs. Secondly, unlike traditional loans, car title loans use your vehicle’s title as collateral, which means no credit checks or complex eligibility criteria. This accessibility is particularly advantageous for those with less-than-perfect credit histories.

However, it’s essential to consider the repayment implications. Car Title Loans typically come with shorter repayment periods and higher interest rates compared to conventional loans. Texas residents should also be aware of potential hidden fees and thoroughly understand the Loan Requirements and Repayment Options before committing. Transparency is key; lenders should clearly outline all charges, ensuring borrowers are fully informed about their financial obligations.

In conclusion, Texas City car title loans offer a swift financial solution for residents needing quick cash. This alternative lending method leverages your vehicle’s equity, providing access to funds without the stringent requirements of traditional loans. However, it’s crucial to understand the benefits and considerations involved to make an informed decision. By exploring this option, you can gain immediate financial support while maintaining the use of your vehicle.