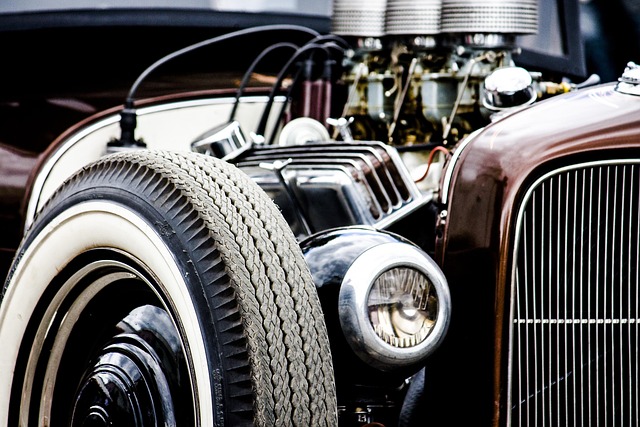

Texas City car title loans provide quick funding for residents needing cash immediately. Secured by vehicle equity, these loans offer online applications, minimal requirements, and fast approval times. Ideal for unexpected expenses, they assess vehicle value for lump sums, with repayment involving interest and a set period. However, failure to repay can lead to repossession and higher fees, emphasizing the need for thorough understanding of terms.

In the competitive financial landscape of Texas City, understanding car title loans can be a game-changer. This straightforward guide deciphers the intricacies of Texas City car title loans in simple terms. We’ll walk you through the process, from “How Do Car Title Loans Work?” to exploring the key benefits and potential risks. By the end, you’ll have a clear picture of this unique lending option tailored for your needs.

- Understanding Texas City Car Title Loans

- How Do Car Title Loans Work?

- Benefits and Risks Explained Simply

Understanding Texas City Car Title Loans

Texas City car title loans are a type of secured lending where individuals can use their vehicle’s equity as collateral to secure a loan. This option is designed for those who need quick funding and have a clear vehicle ownership, typically with no remaining loan on it. It’s a straightforward process that involves using your car’s registration and title as security.

The online application process makes it even more convenient. Borrowers can apply from the comfort of their homes, providing essential details about their vehicle and financial background. Once approved, the lender will assess the value of the vehicle and offer a loan amount based on its equity. This type of loan is ideal for Texas City residents facing unexpected expenses or those looking for a swift solution to bridge a financial gap without the usual lengthy application procedures associated with traditional loans.

How Do Car Title Loans Work?

Texas City car title loans are a type of secured loan where the borrower uses their vehicle’s title as collateral. It’s a simple process designed to provide quick funding for those in need of immediate cash. Here’s how it works: You bring your vehicle and its title to a lender, who will assess its value. If approved, you receive a lump sum based on the car’s worth. Unlike traditional loans where credit checks are rigorous, Texas City car title loans focus more on the vehicle’s equity than the borrower’s credit history.

The loan terms typically involve repaying the amount borrowed plus interest over a fixed period, often with the option to extend or refinance the loan if needed. San Antonio loans, for instance, follow similar principles but may have varying requirements and rates depending on the lender. The key advantage lies in the flexibility it offers during challenging financial times, as borrowers can retain their vehicle while gaining access to much-needed funds.

Benefits and Risks Explained Simply

Texas City car title loans can be a convenient financial solution for those needing quick cash. These loans are secured by your vehicle’s equity, which means the lender has a claim on your car until the loan is repaid. One of the main benefits is accessibility; with a clear vehicle title and a reliable vehicle, you can borrow money without strict credit checks. This option is particularly appealing to individuals who may not qualify for traditional loans due to poor credit scores or other financial constraints.

However, there are risks associated with car title loans. If you fail to repay the loan as agreed, the lender has the right to repossess your vehicle. Additionally, these loans often come with higher interest rates compared to other borrowing options, and if you need to extend the loan term, it can lead to even more expenses. It’s crucial to understand the terms and conditions thoroughly before pledging your vehicle’s equity, ensuring you’re comfortable with the repayment process and are aware of any potential penalties or fees.

Texas City car title loans can provide a quick solution for those in need of cash. By using your vehicle’s title as collateral, you can access funds without the strict credit requirements typically associated with traditional loans. However, it’s crucial to understand both the benefits and risks involved before making a decision. While these loans offer flexibility and speed, they also come with potential drawbacks like high-interest rates and the risk of repossession if payments aren’t met. Always weigh your options carefully and choose a reputable lender to ensure the best possible experience with Texas City car title loans.