Texas City car title loans offer quick funding for emergencies, secured by vehicles, with less strict credit checks. Top lenders provide flexible terms and same-day access, but late repayments may result in losing vehicle ownership. Researching terms, reputation, and rates is vital to choose a reliable provider among competitive options in Texas City.

“In the competitive landscape of Texas City, understanding your options is key when considering a car title loan. This comprehensive guide aims to demystify the process, providing insights into how Texas City car title loans work and highlighting top-rated providers in the area. From interest rates to repayment terms, we’ll equip you with the knowledge to make an informed decision. By weighing crucial factors like lender reputation, service accessibility, and loan terms, you can secure the best possible deal for your needs.”

- Understanding Texas City Car Title Loans: A Comprehensive Guide

- Top-Rated Providers in Texas City: Uncovering Their Services

- Key Factors to Consider When Choosing a Title Loan Lender

Understanding Texas City Car Title Loans: A Comprehensive Guide

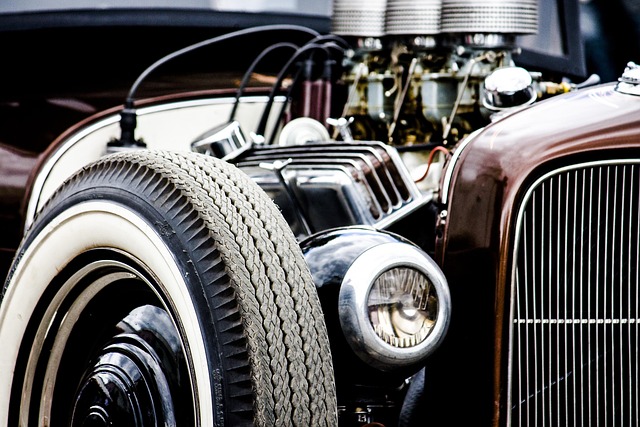

In Texas City, Texas, Texas City car title loans have emerged as a popular solution for individuals seeking rapid and convenient emergency funding. This type of loan is secured by the borrower’s vehicle, typically their car, which serves as collateral. The process involves a straightforward application where lenders assess the vehicle valuation to determine the loan amount, ensuring it aligns with the car’s current market value. Unlike traditional loans, these titles loans offer faster approvals and often have less stringent credit requirements, making them accessible to a broader range of borrowers.

Understanding Texas City car title loans begins with grasping how they work. Lenders conduct a thorough inspection of the vehicle, evaluating its condition and year to set the loan terms, including interest rates and repayment periods. This alternative financing option is particularly useful for those facing unexpected expenses or requiring immediate access to cash. However, it’s crucial to approach these loans mindfully, considering the potential consequences if unable to repay on time, which may include losing ownership of the vehicle.

Top-Rated Providers in Texas City: Uncovering Their Services

In the competitive landscape of Texas City, several providers have distinguished themselves as top-rated when it comes to car title loans. These establishments offer a range of services tailored to meet diverse financial needs, making them popular choices among locals. Among the key factors that set these leaders apart is their flexibility in terms of payments, allowing borrowers to manage their loans comfortably without the usual strain.

The title loan process with these providers is generally streamlined and efficient, offering same-day funding as a standard feature. This ensures that customers can access the funds they need promptly, making them ideal for unexpected expenses or urgent financial requirements. By combining flexibility in repayment terms with swift funding, these top-rated Texas City car title loan providers deliver an exceptional customer experience, solidifying their reputation in the market.

Key Factors to Consider When Choosing a Title Loan Lender

When comparing Texas City car title loans providers, several key factors come into play. Firstly, consider loan terms and ensure they align with your repayment capacity. Different lenders offer varying loan durations, interest rates, and monthly payment plans, so choose one that provides flexible options tailored to your needs. Secondly, look into the loan requirements. Each lender has specific criteria for borrower eligibility, including minimum income, vehicle age, and title ownership. Ensure you meet these requirements before applying.

Additionally, research the lender’s reputation and customer reviews to gauge their reliability and transparency. Check if they offer clear communication, efficient processing, and competitive rates without hidden fees. Validating these aspects will help secure a loan that supports your financial goals while providing emergency funds when needed.

When it comes to navigating the complex world of Texas City car title loans, choosing the right provider is essential for a seamless and beneficial borrowing experience. By understanding your options, comparing key factors, and selecting a top-rated lender, you can access much-needed funds quickly and efficiently. Remember, an informed decision regarding your loan is crucial, ensuring you receive the best terms and service tailored to your needs in Texas City.